Yuki Matrix

Shareholder Returns = Dividends + Periodic Capital Appreciation

EPS (earnings) are fundamental to valuation

The Main pillar of stock price appreciation is PER (Growth Thesis)

PER-driven capital appreciation gains are bigger than gains caused by increased dividends from EPS growth

Gains from BPS increases due to EPS growth are basically shrinking

Since 2001 we can see that the TOPIX has traded based on changing earnings models

In other words, we must look at company earnings to understand PER, which is the biggest predictor of stock price appreciation.

EPS (earnings) are fundamental to valuation

The Main pillar of stock price appreciation is PER (Growth Thesis)

PER-driven capital appreciation gains are bigger than gains caused by increased dividends from EPS growth

Gains from BPS increases due to EPS growth are basically shrinking

Since 2001 we can see that the TOPIX has traded based on changing earnings models

In other words, we must look at company earnings to understand PER, which is the biggest predictor of stock price appreciation.

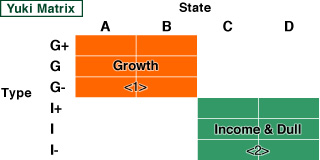

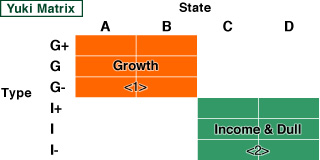

The Yuki Matrix distinguishes between

-

<1>

companies that trade based on PER by recording higher relative

earnings (Growth) from - <2> companies that trade on some other metric (Income)

- Valuation of companies through analysis of specific items from the balance sheet and income statement (historical data and estimates of current period figures).

- Plot all companies as Growth (6 categories), Income and Dull (6 categories).

- For a growth-type fund focus on { G+ } and { G }, and pick stocks selectively from group { I+ }.